Innovation & Leadership

The Massachusetts Housing Partnership (MHP) was created in 1985 to foster civic leadership on affordable housing and break down local barriers to housing development through effective guidance, advocacy, research and technical support. Our mission is to pioneer new development and financing models that make more effective use of public resources, are responsive to local needs, promote racial equity, and achieve more impact than conventional approaches to affordable housing.

Toward that end MHP has used its hands-on experience at the local level and its expertise in data analysis and policy to propose, develop and implement a significant array of state housing programs, policies and resources.

New and Expanded Community Tools

Enacted an authorizing statute for municipal affordable housing trusts, developed, published and regularly update a housing trust handbook and operations manual, and continue to sponsor periodic training programs and direct technical assistance for local trusts.

Researched, published and regularly update a guidebook and continue to sponsor regular trainings on the use of Community Preservation Act funds for affordable housing.

Designed, launched and manage the annual Massachusetts Housing Institute, which has provided an intensive two-day training program for local officials for the past 16 years and reached well over a thousand local housing leaders.

Created and maintain the Housing Toolbox for Massachusetts Communities in collaboration with Citizens Housing and Planning Association.

Convened a group of diverse stakeholders to create and publish guidelines for local zoning board review of comprehensive permits for construction of affordable housing pursuant to Chapter 40B. Combined that guidance with no-cost, third party consultant support that to date has assisted 221 local zoning boards in reviewing 413 housing development proposals.

Support for Community-Based Nonprofits

Designed, funded and administered a $7 million capital and operating support program for community development corporations (CDCs) that provided a financial lifeline to 46 organizations prior to enactment of the state community investment tax credit. Convened key stakeholders to brainstorm a shared-support business model to strengthen the financial viability of existing CDCs, which led to the successful launch of Opportunity Communities, Inc. (OppCo).

Provided $4.2 million in grants and $15 million in below-market lines of credit to the Community Economic Development Corporation (CEDAC) to extend the reach of its successful predevelopment and acquisition loan programs for CDCs and other community-based nonprofit housing developers. Directly provided $1.8 million in low-cost, unsecured working capital lines of credit from MHP to 12 CDCs.

Promotion of Walkable, Transit-Oriented Neighborhoods

Designed and launched the Complete Neighborhoods Initiative to promote vibrant, mixed-use development in walkable and transit-oriented neighborhoods. The program combines technical assistance and predevelopment support with state capital investment for affordable housing in communities designed as Complete Neighborhood Partnerships.

With financial support from MassDOT and the Barr Foundation, designed and launched a $2.5 million comprehensive technical assistance program for the 177 cities and towns in the MBTA service area that are now required by law to have districts zoned for multifamily housing as-of-right.

Innovative Financing

Designed and launched a successful $1.5 billion bank-funded multifamily loan program backed by the only state community reinvestment law of its kind in the U.S. That funding has supported the development and preservation of more than 26,000 rental housing units through long-term fixed-rate permanent mortgage loans that are originated and serviced by MHP. In combination with Fannie Mae and Federal Housing Administration loan products, MHP has financed more than 30,000 apartments while experiencing zero loan losses during thirty years of operation.

Designed, launched and administer the ONE Mortgage program (formerly known as the SoftSecond Loan Program) which eliminates barriers to first-time homeownership, especially borrowers of color. The program combines a discounted rate from participating banks and credit unions with a graduated payment structure and is backed by a shared loss reserve to eliminate the monthly cost of mortgage insurance. The program was developed by MHP, the Massachusetts Bankers Association and community partners in response to a 1989 Federal Reserve Bank of Boston study finding widespread racial bias in mortgage lending. It has subsequently provided more than $4.6 billion in financing for more than 24,000 home purchases, more than half by households of color.

Teamed up with the City of Boston and with several leading banks to create the ONE+Boston program, which combines the city’s Community Preservation Act funding with MHP’s ONE Mortgage to provide deep down-payment assistance and a “buydown” of 30-year mortgage rates. The program dramatically increases the buying power of income-eligible, first-time Boston homebuyers purchasing a home within the city and has been highly effective in enabling households of color who would otherwise be priced out of the market to purchase homes and remain in Boston.

Designed and launched the HomeSafe program in collaboration with the Massachusetts Affordable Housing Alliance. HomeSafe is a statewide network of nonprofit counseling agencies that provide post-purchase education and support to homebuyers in the ONE Mortgage program and qualifies them for homeowners insurance discounts. HomeSafe counselors are automatically notified to offer counseling whenever ONE Mortgage payments are delinquent.

Developed OneSource financing for new housing construction in collaboration with the Massachusetts Housing Investment Corporation (MHIC). OneSource provides construction and permanent financing for multifamily housing development using a single set of loan documents, one attorney and joint engagement of a single appraiser and inspector. This coordinated approach saves time and money and has now been adopted by multiple lenders.

Developed the Housing Reserve Assurance Program (Housing RAP), in collaboration with The Boston Foundation, to reduce the need for cash-funded operating reserves for affordable housing developed by nonprofit sponsors, particularly since those reserves are rarely drawn. It covers up to 80 percent of reserve requirements with a line of credit, which allows nonprofits to retain a larger share of their developer fee for developments utilizing Federal Low Income Housing Tax Credits.

Designed and launched a green and healthy housing program that provides discounted long-term mortgage interest rates and covers certification costs for multifamily developments that meet rigorous energy-efficiency and health standards.

System Reform

Created and maintain the award-winning MassDocs online loan closing platform to standardize legal documents and reduce transaction costs for affordable housing development. The MassDocs platform and its shared standards are now used by every state housing agency and by 57 cities, towns and other local financing partners in Massachusetts.

Drafted a state policy and interagency agreement that requires the inclusion of at least 10 percent family-sized units (three or more bedrooms) in most state-subsidized affordable housing developments.

Worked closely with the Massachusetts Department of Revenue (DOR) on a public affirmation that income-restricted affordable housing properties must be assessed and taxed at their restricted below-market value by local assessors. This state policy was reaffirmed by a decision of the state Appellate Tax Board based on MHP’s expert testimony.

Published an MHP assessment of rural housing needs in the Commonwealth that resulted in a state law to create a Rural Policy Advisory Commission.

Published a guidebook on development of affordable housing on public land, in collaboration with the state Attorney General and Inspector General’s offices, that has been combined with direct MHP technical assistance to support the successful development of more than 4,000 new housing units in 60 cities and towns.

Housing Data Tools

Created DataTown, an online data portal that makes comparative housing, community and demographic data easily accessible for community leaders and other non-technical users.

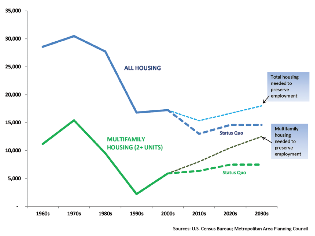

Created the Transit-Oriented Development Explorer (TODEX) which analyzed housing development patterns around each of 261 subway, rapid transit and commuter rail stations in metro Boston and helped lead to adoption of the MBTA multifamily zoning law in 2021 after nearly a decade of MHP advocacy for a multifamily zoning mandate.

Developed RESiDENSiTY, a user-friendly database and online mapping tool launched in early 2023, that allows non-technical users to analyze data on 2+ million residential parcels and explore existing housing densities and housing development patterns at the community, neighborhood, street or parcel level in every city and town in Massachusetts.

Policy Analysis and Advocacy

Created the MHP Center for Housing Data with a dedicated data, policy and research staff to better inform state and local leaders about housing needs and opportunities and to advance new and innovative state housing policies.

Researched and published MHP’s 2014 Unlocking the Commonwealth report to the state legislature, which made the case that underproduction of housing was harming the Massachusetts economy and laid the groundwork for the next seven years of housing production legislation.

Partnered with the Public Policy Center at UMass Dartmouth on an economic analysis showing that multifamily housing development has a substantially net positive state and local fiscal impact. The study found that adverse local fiscal impacts from multifamily development, including increased public education costs, are generally small and infrequent and that net new state revenue resulting from the development is more than adequate to compensate for them.

Commissioned Recipe for Growth, a study by economist Edward Moscovitch that examined more than two decades of national data and found that adequate housing production over the long term is a prerequisite for strong job growth.

Published an analysis of housing supply and density in Massachusetts, with financial support from The Boston Foundation, which showed the feasibility of increasing housing production enough to meet demand while simultaneously reducing the consumption of open space for new development.

Commissioned an engineering analysis and policy brief showing the potential to encourage modest scale multifamily housing development by improving state and local septic and wastewater treatment regulation.